Account:

- Accounting is an art of recording, classifying and summarizing in a significant manner and in terms

- of money transaction and events.

- Accounting means collecting and recording information for making decision.

- Accounting is known as business language.

Advantages of Accounting

- Maintain a complete record of all financial transaction in the book of account.

- Show the true and fair financial position of the business

- Useful for comparison purpose.

- Provide useful information insider and outsider for taking right decision

- Helpful in controlling and detecting frauds.

- Helpful to the management day to day decision.

- Tax liabilities can be determined.

Disadvantages of Accounting

- No mounting events are not recorded in accounting.

- Accounting data is sometimes based on estimation & estimation may be incorrect.

- It does not provide information to analyze the losses.

- Lack of completeness and clearness.

- Lack of Proper understanding.

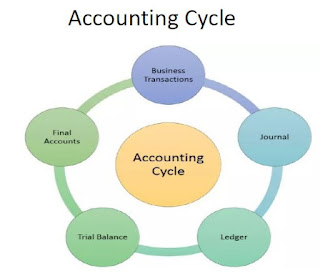

Accounting Cycle or Step of Accounting

- Transaction

- Journal / Daybook (rojmel) Primary book of account

- Ledger (Khatavahi) Master book of account

- Balance (process) Debit and credit difference

- Trial Balance Different ledger of account

- Final Account

- Income/Expense statement or P & L statement

- Balance sheet (Pakku sarvaiyu)

- Assests = Liabilities + capital

Basic Terms used in Account

-----------------------------------------------------------------------------------------

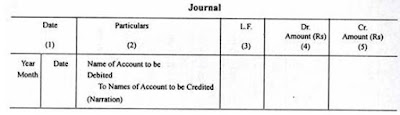

Journal

• All transactions are recorded in one book only is called journal.

• All transactions are recorded in two parts. Like debit side and credit side entry.

Journal entry (What does a journal entry include?)

date of the transaction

name of the account debited

name of the account credited

ledger folio (optional)

amount of the debit and credit

description of the transaction (narration)

-------------------------------------------------------------------------------------------------------------

Ledger

• A book in which thing are regularly recorded, specially business activities and money received or paid. It is separate book.

• Businesses that use the double-entry bookkeeping method of recording transactions make the accounting ledger. Each transaction is recorded into at least two ledger accounts. The entries have debit as well as credit transactions and are posted in two columns.

• For example, Creditors ledger, debtors ledger, personal ledger, purchase ledger, sales ledger, general ledger.

-----------------------------------------------------------------------------------------------------------

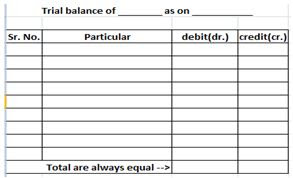

Trial Balance

• Trial balance is a bookkeeping worksheet in which all the debits and credit entry.

• And end the last of page debit and credit column totals that are equal.

• The format of trial balance is a two column, with all debit entries listed in one column and all credit entries listed in another column.

• A company prepared trial balance periodically. Usually at the end of every reporting period.

• For example,

• Asset, Expenses are debit side

• Revenues, Liabilities, Equity are credit side

------------------------------------------------------------------------------------------------------------

Trading Account

• We prepare one account, on one side of that account total purchase, as well as all expenses.

• on the other side total sales as well as incomes. The difference between two sides is called Gross profit.

• The account shows gross profit is also known as Trading account.

-------------------------------------------------------------------------------------------------------------

Profit & Loss Account

• If any administrative expenses and selling expenses are deducted from gross profit, So, we get net profit.

• The account shows net profit is also known as profit & loss account.

-------------------------------------------------------------------------------------------------------------

Waste book

• We note down the household expenses or our pocket expenses in a waste book.

• The entry in a waste book are not a part of account.

------------------------------------------------------------------------------------------------------------

Cash book

• Only cash transaction are recorded.

• When cash or cheque receive then enter receipt side

• When cash or cheque paid or issued then enter payment side

-----------------------------------------------------------------------------------------------------------

Balance Sheet

• Balance sheet view Assests and liabilities

• Where liabilities view on left side and Assests on right sheet

• At the end of page both side totals are always equals.

• Balance sheet is part of Final Account.

• Balance sheet prepare at the end of financial year.

------------------------------------------------------------------------------------------------------------

Download link for more detail: Basic Terms of Accountancy

For more detail about Accounting Terms: Click here

Or follow my blog from below link

https://cdprajapati.blogspot.com/p/blog-page.html

0 Comments